IB Financial Modelling – Fundamentals

About Instructor

Course Overview

This course is intended for people that have limited or no knowledge of corporate finance, investment banking industry and financial modelling.

To pursue an Investment Banking or Private Equity career a candidate who wants to apply for such job needs to know the basics of how to prepare a financial model, what is a company valuation, what are its parameters, how is prepared an information memorandum and many other skills. Investment banking candidate selection is done via 3 to 6 rounds, without the mentioned skills the candidate can be able to pass the first online tests but will then struggle and unable to pass the subsequent rounds.

Figures that will benefit from this course may include:

- Master Students, Graduates or PostGraduates with an economic or scientific education that want to increase their knowledge in numeric modelling to develop a career in Investment Banking or Finance

- Investment banking or Financial professionals that want to increase or refresh their financial modelling skills

Course summary

CURRICULUM

Link to PDF Sample (soon available)

- EBITDA and

- IRR (Internal Rate of Return)

- Free and Paid financial databases (S&P, Bloomberg, Factset etc.)

- Analysing an investment proposal

- Normalisation of a financial statement for analysis purpose

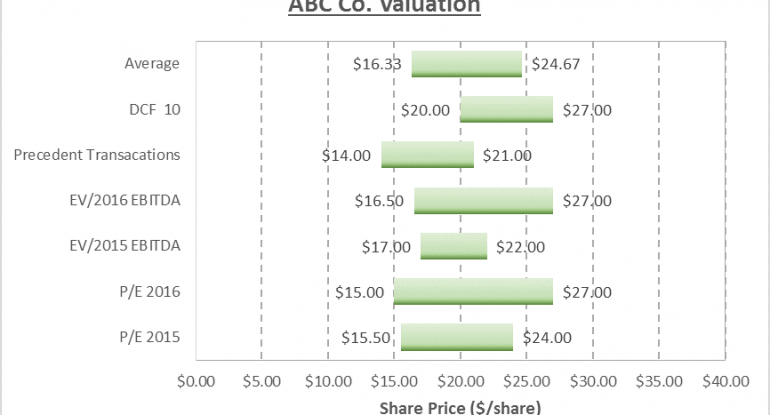

The trainer will provide to the candidates real values of a private business operating in the market, for which a previous professional valuation has been done. The candidate will have to bring those data into an excel worksheet building from scratch a full Investment Banking Financial Model and a basic company valuation.

Video Link (coming soon)

Video Link (coming soon)

Reviews

There are no reviews yet.