IB Financial Modelling – Full Course

About Instructor

Course Overview

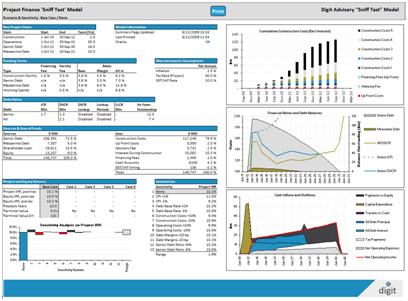

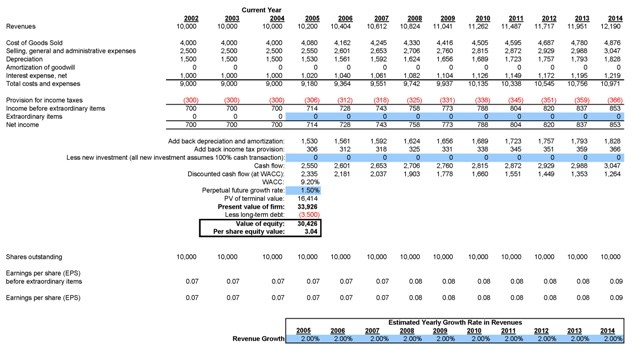

This is an intensive course at the end of which you can surely claim in your CV that you know what a Financial Model is! The course is intended for people with minimal or no experience of the investment banking (IB) and private equity (PE) sector, but with the willingness to enter in this market as a future job, because the actual job role is requiring it or simply to understand the IB/PE mechanism for a larger strategic vision of the market. The course after an overview of the industry will teach to the candidate the fundamental steps and tools used in the investment banking and private equity industry, going after into the details of the various type of valuation methods, merger model and accretion dilution model for public listed companies.

The course can be also useful to entrepreneurs that want to acquire investment skills to improve their own businesses.

Figures that will benefit from this course may include:

- Students, Graduates, PostGraduates (who want to enter in the IB/PE Industry)

- CEO, CFO (operational and financial decision makers in general)

- Business Development Managers, Marketing Managers etc. (expansion and marketing figures)

- Entrepreneurs

NOTE: This is an Intensive course which will almost require (depending on candidate ability and experience) extra work at home during the 6 days.

Course summary

CURRICULUM

Detailes are usually located in the notes of the FS. The course will give you an overview on how to spot the information you need in order to decompose to basic blocks the FS and get the information you need to build the financial models.

Link to PDF Sample (soon available)

The Video will show a simple company valuation

Video Link (coming soon)

The Video will show how to compute the Merger of two Public Listed Companies

Video Link (coming soon)

The Video will show how is conducted the research of good Trading and Transaction Comparables for a selected transaction

Video Link (coming soon)

Reviews

There are no reviews yet.